Support Article

The Basics of Trading: Buying and Selling Cryptocurrencies

Trading Guide

Back to all support articles

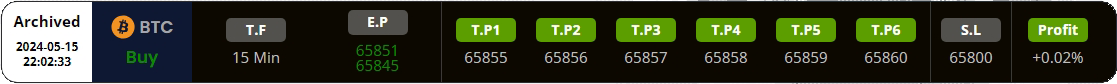

Each signal contains the following information:

Coin:

- The name of the proposed currency for the transaction

T.F: Stands for “Time Frame”

T.F: Stands for “Time Frame”

- Simply put, this concept indicates the time frame during which price changes have been analyzed.

For example, "T.F: 1H" means the respective cryptocurrency has been analyzed over a one-hour period.

- The standard time frames in GetRichEX are as follows:

15 Min: 15 minutes

30 Min: 30 minutes

1H: 1 hour

2H: 2 hours

4H: 4 hours

1D: 1 day

- If you come across with the phrase “scalp” in the signal’s “T.F”, it means you should immediately enter the transaction and that signal will expire very soon.

- If you come across with the phrase “pending order” in the signal’s “T.F”, it means we have not yet entered the buying or selling range, but we will enter this range soon and you must open an order at the suggested point or points.

E.P: Stands for “Enter Price”

E.P: Stands for “Enter Price”

- “E.P” is the point where you should open your order. “E.P” is sometimes a price and sometimes a price range. If you come across a price range in the signal’s “E.P”, according to your own trade strategy or “our trading strategy”, enter part of the capital in the first point and part in the second point.

T.P: Stands for “Take Profit”

T.P: Stands for “Take Profit”

- Refers to a point or points where a trader has determined through analysis that it is an appropriate region for taking profit or exiting a trade. These points are strategically chosen, and a trader reaches them using various technical and fundamental analysis techniques. A signal may have just one or multiple Take Profit.

- GetRichEx signals can have between 1 and 6 targets, and you should save part or all of your capital at each of these points according to your trading strategy or “our trading strategy”.

S.L: Stands for “Stop Loss”

S.L: Stands for “Stop Loss”

- This is a point designated as the limit of loss in a trade. Sometimes, market trends may move contrary to analysts' predictions. To prevent further losses, traders always specify a point as their "Stop Loss". If the price drops to this point, they exit the trade with minimal loss.

Recommended Articles

- For an introduction to working with the Signals page, visit this article:

"Introduction to the Signals Page" - For a tutorial on using signals in Manual Trade mode, visit this article:

"Tutorial on Using Signals in Manual Trade Mode" - For a tutorial on using signals in Auto Trade mode, visit this article:

"Tutorial on Using Signals in Auto Trade Mode" - For an introduction to the GetRichEx recommended trading strategy, visit this article:

"Our Trading Strategy"

Make profit and GET RICH!